The money is in the timing

Background

With cashflow more important than ever for businesses within the construction industry, it is crucial to plan ahead to determine the best approach to recover money owed to you under your construction contract. There are various forums which can be considered, whether that be commercial negotiation, litigation, arbitration, the statutory demand process under the Commonwealth corporations law or the commonly utilised statutory adjudication under the Security of Payment legislation in each state or territory.

There are a number of factors that will inform your options such as the type and terms of the relevant contract and the amount and nature of the payment sought. This includes whether there is a genuine dispute about the amount owed (and the nature and complexity of that dispute). In this article, we focus on the practical implications of the recent reforms to the insolvency and corporations laws and how those changes should be factored into your thinking when formulating a debt recovery strategy.

Creditor’s Statutory Demand

In what was a significant change to the insolvency laws in Australia, on 22 March 2020, the Australian Federal Government passed temporary amendments to insolvency and corporations laws due to the COVID-19 pandemic causing challenging times to many otherwise profitable businesses. The changes were made in order to avoid any unnecessary insolvencies and bankruptcies.

The amendments mean that directors will be temporarily relieved from the risk of personal liability for insolvent trading, where the debts are incurred in the ordinary course of business. The temporary relief will operate for six months from 25 March 2020. Further to this, and over the same six-month period, the minimum threshold which creditors can issue a statutory demand has increased to $20,000 (previously $2,000). Companies will also have six months to respond to a statutory demand (previously 21 days).

This temporary regime significantly limits the utility of the statutory demand process as a means to recover overdue payments. A number of industry participants in the construction and infrastructure sector have already voiced their concerns with respect to the impact that this will have on projects, particularly given the hierarchical contractual chain that is commonly encountered, and the impact of non-payment by any one party in that chain.

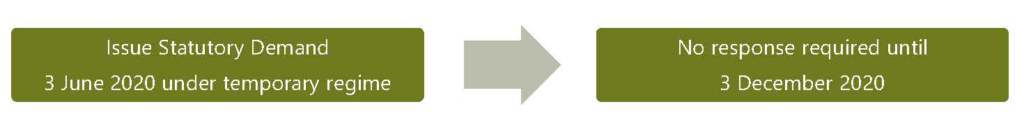

Given we are at now in June 2020, and the fact that the legislation will not revert back to the 21-day response time until 25 September 2020, it makes little sense for anyone to issue a creditor’s statutory demand under the temporary regime (where a company will have six months to respond). At this juncture, the response period would extend to December 2020, as opposed to issuing a creditor’s statutory demand on 28 September 2020 (which would require a response by 19 October 2020).

We have set out a graphical representation of the two scenarios below:

Scenario one – issue statutory demand now:

Scenario two – issue statutory demand on 28 September 2020:

Security of Payments legislation

One alternative to issuing a creditor’s statutory demand, particularly if there is a genuine dispute to be resolved, creating the potential for the creditor’s statutory demand to be set aside, is to utilise the security of payment regime in your respective state or territory.

Queensland

In Queensland, the Building Industry Fairness (Security of Payment) Act 2017 (QLD) (BIF Act) applies if you have a contract, agreement or other arrangement (whether written or oral) under which one party undertakes to carry out construction work for, or supply related goods or services to, another party for construction work in Queensland.

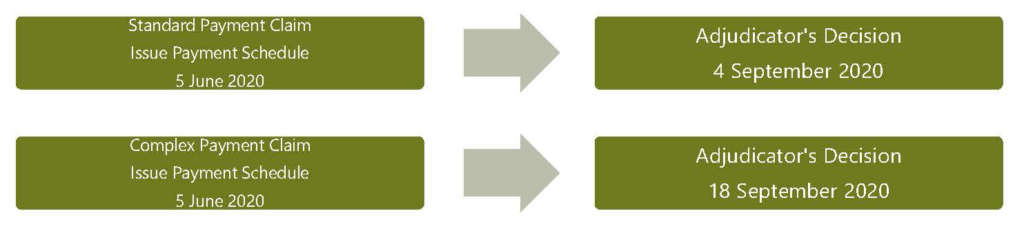

The timing of the process under the BIF Act from the issuing of a payment claim to receiving the adjudicator’s decision is approximately 65 business days[1] for a standard payment claim ($750,000 or less) or 75 business days[2] for a complex payment claim (over $750,000). For example:

both being earlier than any expected response if a creditors statutory demand is issued on 28 September 2020 once the legislation reverts to the old regime.

New South Wales

In New South Wales, the Building and Construction Industry Security of Payment Act 1999 (NSW) (SOPA) applies if you have a construction contract, (written or oral or partly written and partly oral), even if the Contract is expressed to be governed by the law of a jurisdiction other than New South Wales.

The timing of the process under SOPA from issuing the payment claim to receiving the adjudicator’s decision is, generally, approximately 25 – 35 business days.[3] See the graphical example below[4]:

Conclusion

If you are seeking prompt resolution of a payment dispute and are formulating a strategy in relation to potential payment recovery options, you should consider the material impacts of the temporary legislative amendments to statutory demand process.

The security of payment regimes in each state and territory remain a viable alternative option for the (relatively) quick and cheap resoution of payment disputes. Of course, many factors will be relevant in determining the suitability and appropriateness of engaging applicable security of payment regimes, including whether the legislation applies to your particular circumstances and whether the interim nature of the relief provided by the legislation is likely to result in a suitable resolution of the issues in dispute (as opposed to further escalating those disputed issues).

[1] Unless a shorter period is prescribed in the contract for how long a respondent has to issue a payment schedule in response to a payment claim.

[2] Ibid.

[3] This timing may vary depending on the timing of service of the payment schedule (including where the contract provides a shorter time-period that the ‘default’ position in the legislation), whether or not a payment schedule is issued at all and whether the parties agree to extend the time for the adjudicator to issue the adjudication determination.

[4] Ibid.

This publication covers legal and technical issues in a general way. It is not designed to express opinions on specific cases. It is intended for information purposes only and should not be regarded as legal advice. Further advice should be obtained before taking action on any issue dealt with in this publication.