Terms of business

1 Effect of our terms of business

1.1 These terms are an offer to enter into a costs agreement as defined in the Legal Profession Act 2007 (Qld). Division 7 part 3.4 Legal Profession Act 2007 (Qld) does not apply to this costs agreement.

1.2 If you are happy with the terms, please confirm your acceptance by sending us an email (or other written acceptance), calling us or continuing to instruct us. By continuing to instruct us, you will show you accept the terms.

1.3 We may from time to time vary the terms (with prospective effect) by sending you updated terms. If you do not agree to these updated terms, you may terminate this agreement by giving us written notice.

2 Fees and costs

Estimate of fees and costs

2.1 Many factors outside our control may impact the estimate of fees and costs (if any) we have given you. We will keep you informed if the estimate is likely to change.

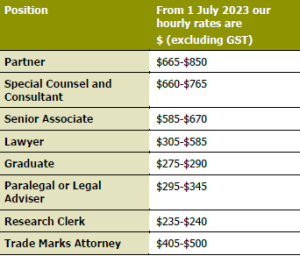

Our professional fees

2.2 Unless otherwise agreed, we charge professional fees for the work we do based on the following hourly rates:

2.3 Our hourly rates generally increase on 1 July each year. We may also increase the hourly rates (with prospective effect) by written notice to you. If you do not agree to the increased hourly rates, you may terminate this agreement by giving us written notice.

2.4 Secretarial and word processing costs are included in the hourly rates unless those services are required outside normal business hours when those services may be charged at $80 per hour (excluding GST).

2.5 To calculate time charged, we operate on units of six minutes. The cost of each unit is 10% of the hourly rate of the person doing the work. If the time taken is less than six minutes, one unit (six minutes) is charged. If the time taken is not an exact multiple of six minutes, the time charged is rounded up to the next multiple of six minutes.

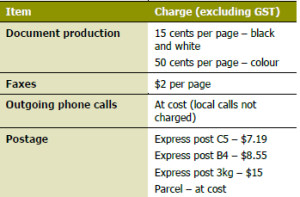

Office costs

2.6 Unless otherwise agreed, we may charge the following office costs for the work:

2.7 We may increase the office costs (with prospective effect) by written notice to you. If you do not agree to the increased office costs, you may terminate this agreement by giving us written notice.

Third party costs

2.8 It may be necessary to incur other costs (payable to third parties) in the performance of the work we do for you e.g. searches, registration fees etc.

2.9 We will seek your express authority before incurring any cost which is not normally incurred in the performance of work similar to the work we are doing for you.

2.10 In general, we will incur these costs as your agent. However, some costs may be incurred by us directly e.g. expert consultants’ fees, travel, accommodation, search costs and outsourced document production costs. In that case, the amount you pay us for the costs (before adjustment for GST) is the amount incurred by us, less any GST input tax credits claimable by us.

2.11 Some or all of the third party costs incurred may not be recoverable from another party, even in circumstances when another party may be liable to pay your costs.

GST

2.12 Fees and costs incurred for the work are generally subject to GST (which at the date of this agreement is 10%) if there is a sufficient connection with Australia. If so, we are required to remit GST and (excluding those costs incurred as your agent) we will charge the applicable GST in addition

3 Accounts

3.1 Unless otherwise agreed, we generally issue accounts electronically on a monthly basis and at completion of the work.

3.2 You agree to pay the account within 14 days of the date of issue. We reserve the right to charge interest on overdue accounts at the rate equal to the cash rate target set by the Reserve Bank of Australia (as at the date the account was rendered) plus 2%.

3.3 Our credit reporting policy sets out how we handle credit related information. You may obtain a copy of our policy here or by contacting the Privacy Officer at McCullough Robertson on +61 7 3233 8888.

3.4 Credit card payments incur a surcharge of 1.29% (Visa, Mastercard) or 2.19% (AMEX).

3.5 You authorise us to pay an account from money held in trust on your behalf for fees and costs, if we notify you in writing that trust money will be transferred from trust to pay the account.

4 Queensland trust account

4.1 We have sought and obtained the approval of both the Queensland Law Society and the Law Society of New South Wales to maintain one general trust account operated in Queensland.

4.2 We operate a general trust account in Queensland which is subject to the supervision of the Queensland Law Society and is maintained as required by the Legal Profession Act 2007 (Qld) and Legal Profession Regulation 2017 (Qld), effective at the time monies are deposited.

4.3 You authorise and direct any money received on your behalf by us to be deposited in the general trust account referred to above.

5 Multiple clients

5.1 When acting for more than one person or entity in doing the work, we act in the best interests of each person or entity. If that becomes impracticable or impossible, we will advise each person or entity to seek separate advice.

5.2 When instructions are requested, we must seek the instructions of all clients, except:

(a) on relatively insignificant matters, when we may act on the instructions of one client; or

(b) when we receive instructions from one client, and that client indicates that those are the instructions of all clients.

5.3 All clients are jointly and severally responsible for our fees and costs. That means all clients are responsible for the whole amount but also, each person or entity is individually responsible for the whole amount. Although, you may decide the proportion, that each person or entity must pay for the fees and costs, we are not bound by any decision or agreement between you.

6 Reliance on our advice

6.1 If the advice given by us to you is based on assumptions, qualifications or both, those assumptions or qualifications will be set out in the advice.

6.2 Once the advice is given, we are not liable for any part of the advice that is then found to be incorrect due to a later change in events, further information being given, further assumptions being made or assumptions on which the advice was based proving incorrect.

6.3 Our advice is given exclusively to you. We are not responsible to anyone else, whether in negligence or otherwise, for any loss suffered by them because of them relying on our advice to you.

6.4 We are only responsible for the legal advice we give about Australian laws and regulations. During the term of our engagement you may require us to obtain advice from law firms in non-Australian jurisdictions about laws and regulations in those jurisdictions. We do not accept any responsibility for the content of that advice.

7 Your privacy

7.1 We collect and hold personal information about you. This information may be collected directly from you, indirectly or from third parties acting on your behalf.

7.2 How we use and disclose personal information depends upon your interaction with us. As further set out in our privacy policy, typically we use and disclose personal information to:

(a) provide legal services to you or someone else you know;

(b) provide information about other services that we offer that may be of interest;

(c) provide information relevant to a type of business or area of expertise or interest;

(d) provide an opportunity to meet other people and attend seminars and conferences;

(e) nominate you for third party awards or recognition;

(f) facilitate our internal business operations, including the fulfilment of any legal requirements;

(g) seek your feedback about our services, including requesting your participation and input in market surveys;

(h) analyse our services and customer needs with a view to developing new and improved services; and

(i) obtain a testimonial for us.

7.3 As further set out in our privacy policy, we may disclose personal information to:

(a) third party service providers who assist us in operating our business (including for the purposes listed in 7.2 above);

(b) a purchaser of the assets and operations of our business, if purchased as a going concern;

(c) our related entities and other affiliated organisations so that you may be given information about their services and various promotions; and

(d) another party for a purpose permitted or required by law.

7.4 If personal information given to us is incomplete or inaccurate, it may delay our internal operations and we may not be able to effectively work with you or perform the work.

7.5 Our privacy policy contains detailed information about how:

(a) we collect, hold, use, disclose and secure your personal information;

(b) you access and seek correction of your personal information;

(c) you can complain about privacy related matters; and

(d) we respond to complaints.

7.6 You may obtain a copy of our privacy policy here or by contacting the Privacy Officer at McCullough Robertson on +61 7 3233 8888.

7.7 You must take reasonable steps to ensure that:

(a) any person whose personal information you disclose to us is aware of that disclosure and takes all steps necessary (including providing any notifications and obtaining any consents) to enable us to handle their information lawfully for the purpose for which it was provided to us, and in accordance with our privacy policy; and

(b) any individuals acting on your behalf (for instance, employees), who disclose personal information to us (whether their own or a third party’s), are made aware of our privacy policy and are required to comply with your obligations under this agreement to the extent relevant to their disclosure of personal information to us.

8 Our liability

8.1 If you claim damages from us for loss or damage which is partly attributable to our acts or defaults (including negligence) and partly attributable to:

(a) your own acts or defaults or the acts or defaults of other persons for whose acts or defaults you are responsible; or

(b) the acts or defaults of any one or more other persons, not being partners, employees or agents for whose acts or defaults we are responsible, then we will be liable to you only for that proportion of the loss or damage which our acts or defaults bear relative to the totality of the acts or defaults of all persons causing or contributing to the loss or damage.

8.2 Where any law relating to proportionate liability applies to a claim against us, clause 8.1 does not seek to exclude the operation of that law but will continue to operate to the extent that its operation is consistent with that law.

8.3 Clause 8.1 does not seek to exclude or limit the Competition and Consumer Act 2010 (Cth) (CCA) which shall continue to apply.

8.4 For the purpose of clause 8.1:

(a) ‘you’ includes any person to whom we are liable to pay damages; and

(b) ‘damages’ includes damages, compensation or contribution.

8.5 The CCA provides that there are certain non-excludable guarantees in relation to supply of services to consumers. However, in certain circumstances, the CCA permits suppliers of services to limit their liability for failing to meet such a guarantee to supplying the services again, or paying the cost of having the services supplied again. If we supply you services in circumstances where the CCA permits us to limit our liability in this way, then our liability for failing to meet a guarantee is limited (at our election) to supplying you the services again or paying you the cost of having those services supplied again.

8.6 The above paragraph only applies to guarantees under the CCA and does not affect your ability to make a claim against us founded upon a statute, in tort (including negligence), in equity, for breach of contract or otherwise under the general law, in which case you agree that our liability for any loss or damage you may suffer in connection with the Work or our relationship (however caused, including by our negligence) is capped at AUD20 million. This cap applies to any single or cumulative claims by you, and you agree we may plead this limitation of liability in defence to any claims you may bring against us for any such loss or damage.

9 Promotional material

Unless otherwise agreed, we may disclose that we act for you in our promotional material and when doing so use your corporate logo.

10 Retention of your records

10.1 We will retain your file for seven years after completion of the work, after which it will be destroyed unless otherwise directed by you in writing.

10.2 If you ask for your original file (or part of it), you authorise us to retain a copy of the file, including any confidential information or intellectual property that may be on it.

11 Termination of this agreement

11.1 You may terminate this agreement at any time by giving written notice to us. We may terminate the agreement for any reason (including if we have an interest in a matter for another client that is adverse to your interests) by giving at least seven days written notice to you.

11.2 If the agreement is terminated, you agree to pay us any outstanding fees and costs for the work done up to and including the date of termination. We may retain possession of your file until all outstanding fees and costs have been paid.

12 Problems or complaints

12.1 If you experience a problem with the performance of the work, wish to discuss legal fees or costs or make a complaint, contact the partner responsible for your matter, who will escalate the problem or complaint if necessary.

12.2 If you are not satisfied with the way the problem or complaint has been handled, you may contact General Counsel at McCullough Robertson on +61 7 3233 8888.

12.3 If you are still not satisfied with the way the problem or complaint has been resolved, you may contact the Queensland Law Society on +61 7 3842 5842 or GPO Box 1785, Brisbane, Queensland 4000.